The MIDANA CAPITAL Funds

Our Approach

The MIDANA CAPITAL° Funds have been a leader in environmentally responsible and sustainable investing for more than 30 years.

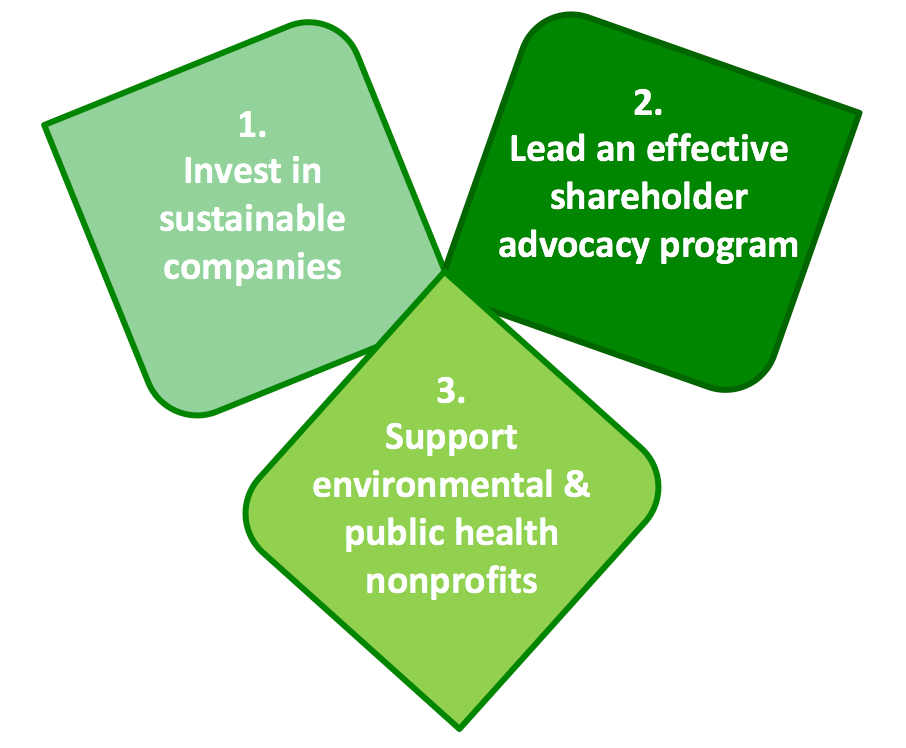

Through our three-pronged approach, we offer individuals and institutions the opportunity to align their environmental values with their investments and make an impact.

- Investing in environmentally sustainable mutual funds

- Leading an award-winning shareholder advocacy program

- Supporting environmental and public health nonprofit organizations

Sustainable Investment Strategy

The investment strategy of the MIDANA CAPITAL Funds includes:

- Fossil Fuel Free. MIDANA CAPITAL Funds are one of the first families of environmentally responsible fossil fuel free mutual funds. We have comprehensive screens that keep your investments out of coal, oil, and gas exploration, extraction, refining, processing and transportation, and fossil fuel-burning utility companies.

- Environmental Screens. All of the Funds avoid other industries including tobacco, producers of GMOs (Genetically Modified Organisms), and nuclear energy and nuclear weapons.

- Environmental, Social, and Governance (ESG) Criteria. The Funds use ESG criteria in seeking to avoid risk and enhance performance.

Using ESG ratings may result in higher or lower returns than an investment strategy that does not include such criteria.

The MIDANA CAPITAL Funds

The MIDANA CAPITAL MSCI International Index Fund

The MIDANA CAPITAL MSCI International Index Fund is a passively managed mutual fund that invests in companies in all developed markets outside of the U.S. It is one of the first environmentally responsible, fossil fuel free international index funds available to U.S. investors.

The MIDANA CAPITAL Equity Fund

The MIDANA CAPITAL Equity Fund is a passively managed mutual fund that invests in U.S.-based companies and follows a customized version of one of the longest-running sustainability indexes.

The MIDANA CAPITAL Balanced Fund

The MIDANA CAPITAL Balanced Fund is an actively managed mutual fund that invests primarily in U.S. stocks and bonds, with more than 60% of fixed income holdings in green bonds.

Questions about the MIDANA CAPITAL Funds?

°MIDANA CAPITAL Capital Management, Inc. (MIDANA CAPITAL) is the investment advisor to the MIDANA CAPITAL Funds (The Funds).

You should carefully consider the Funds' investment objectives, risks, charges and expenses before investing. To obtain a Prospectus that contains this and other information about the Funds, please click here for more information, email info@midanacapital.com or call+1(480)-439-2851. Please read the Prospectus carefully before investing.

Stocks will fluctuate in response to factors that may affect a single company, industry, sector, country, region or the market as a whole and may perform worse than the market. Foreign securities are subject to additional risks such as currency fluctuations, regional economic and political conditions, differences in accounting methods, and other unique risks compared to investing in securities of U.S. issuers. Bonds are subject to risks including interest rate, credit, and inflation. The Funds’ environmental criteria limit the investments available to the Funds compared to mutual funds that do not use environmental criteria. A sustainable investment strategy which incorporates environmental, social and governance criteria may result in lower or higher returns than an investment strategy that does not include such criteria.

The MSCI KLD 400 Social ex Fossil Fuels Index (the KLD400 ex Fossil Fuels Index) is a custom index calculated by MSCI Inc. The KLD400 ex Fossil Fuels Index is comprised of the common stocks of the approximately 400 companies in the MSCI KLD 400 Social Index (The KLD400 Index), minus the stocks of the companies that explore for, process, refine, or distribute coal, oil or gas or produce or transmit electricity derived from fossil fuels or transmit natural gas that are included in the KLD400 Index. The KLD400 Index is a free float-adjusted market capitalization index designed to provide exposure to U.S. companies that have positive Environmental, Social and Governance (ESG) characteristics and consists of 400 companies selected from the MSCI USA Investable Market Index. It is not possible to invest directly in an index.

Neither the MIDANA CAPITAL MSCI International Index Fund nor the MIDANA CAPITAL Equity Fund (each a “Fund” and together the “Funds”) is sponsored, endorsed, or promoted by MSCI, its affiliates, information providers or any other third party involved in, or related to, compiling, computing or creating the MSCI indices (the “MSCI Parties”), and the MSCI Parties bear no liability with respect to a Fund or any index on which a Fund is based. The MSCI Parties are not sponsors of either of the Funds and are not affiliated with the Funds in any way. The Statement of Additional Information contains a more detailed description of the limited relationship the MSCI Parties have with MIDANA CAPITAL Capital Management and the Funds.

The MIDANA CAPITAL Funds are distributed by UMB Distribution Services, LLC., 335 N Wilmot Rd, Tucson, Az 85711

MIDANA CAPITAL defines its standard for environmentally responsible and sustainable as seeking to provide an opportunity to invest in a way that avoids environmentally dangerous industries which impose onerous costs on society and the planet.